Have you ever lived and worked in the UK for 3 or more years and made National Insurance contributions and are now living in Australia?

The UK State Pension

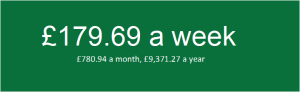

If you have then you should read on, as you could secure an entitlement to a full UK state pension, worth £9,627.80, so about $17,300 p.a. (April 2022) each year, for life from age 67, depending on the year you were born. Over a 20-year retirement that’s nearly $300,000 worth of income in today’s money, assuming a life expectancy of 85.

The UK state pension

Now that I have your attention, for many people, including maybe you, there is a time limited opportunity to cost effectively and significantly increase entitlement to a UK state pension. Under the current rules on filling gaps by making voluntary contributions, (say since you relocated to Australia) it is possible to retrospectively make voluntary contributions for the last 6 UK tax years. However, until 5 April 2023 it is possible (depending on your national insurance record) to purchase up to an additional 10 years of National Insurance Contributions (NICs) gaps for the years 2006 – 2016. This window has already been extended, so from 6 April 2023 the maximum number of years it will be possible to retrospectively purchase, will revert to 6. So it is worth checking your national insurance record before your options to maximise this valuable retirement income are significantly reduced from April 2023.

Key Eligibility

- you must have a minimum contribution records of at least 10 years to be eligible for part pensions, it is pro-rated from 10 to 35 years

- You must have previously worked in the UK for at least 3 years in a row or paid at least 3 years of national insurance contributions (NICs) to be eligible to top up your record by making voluntary contributions

Let’s work through what this could look like for someone in Australia, who with a national insurance record of less than 10 qualifying years, is not currently entitled to any state pension income. However they are entitled to make voluntary contributions to hit the minimum 10-year contribution record:

Peter is 54, lived and worked for over 6 years in the UK before moving to Australia in 2001. Peter doesn’t have 10 qualifying years to make him eligible for a pro-rated pensions, though having worked and paid national insurance contributions for more than 3 full tax years in the UK, he is entitled to increase his contribution record by making voluntary contributions.

Peter generates a state pension forecast online (or you can call +441912183600 or use the BR19 form) and confirms he currently has 6 qualifying years of NICs. As Peter is currently employed in Australia, he could be entitled to purchase NICs for the last 6 UK tax years (2016-2022) and up to 5 April 2023 he may be entitled to purchase a further 10 years (2006-2016). So Peter applied to HMRC by completing the NI38 social security from abroad and as Peter meets the conditions to purchase class 2 NICs (see page numbered 9 in the NI38 form and the relevant passage below this article) if he is approved to purchase 16 years in 2022/23 he will pay £163.80 per year x 16 years = £2,620.80 /AU$ 4,717.44 (1GBP = AU$1.80) as a one off contribution, which we’ll assume he makes.

If Peter then makes no further contributions, he would be eligible for 22/35th (6 already paid + 16 year of gapped he filled) of a state pension which in 2022/23 would be worth £6,051.76 or $10,893.17 per year after retirement age of 67. For a once off contribution of £2,620.80 now, he would get £6,051.76 per year in retirement, in today’s money. I hear you saying this is too good to be true, well read on, as the opportunity to purchase a retirement income so cost effectively is not going to last much longer.

If Peter now contributes every year from here until 67 he would add a further 13 years and be entitled to a ‘full’ pension of £9,627.80/$17,330.04 (1GBP = AU$1.80) per year from age 67.

It gets better, the UK state income is indexed annually. UK state pension income is indexed using a method known as triple lock for this case study let’s say it’s 2% per year. In 13 years, Peter aged 67 that would be £12,200/$21,960 per year (1GBP = AU$1.80). UK state pension for 2022/23 has been indexed by 3.10% increasing from £9,339.20 p.a. to £9,627.80.

Unfortunately as there is currently no reciprocal social security agreement in place between the UK and Australian, indexation will cease in payment i.e. from State Pension Age (SPA) this income will be frozen. However, if Peter ever returned to the UK permanently and updated his address record with HMRC to reflect this, any indexation since he reached state pension age will be applied to any future state pension benefits received.

Note: Any UK Pension income, including the state pension is assessable for income tax in Australia, however it would currently sit under the tax-free threshold if you have no other income (or are drawing tax free from Super)

In 2016 The UK Government announced class 2 NICs were to be abolished from April 2018. However due to the impact this was going to have on self-employed individuals in the UK (engine of many regional economies) the Government deferred this until April 2019. The policy paper was subsequently withdrawn in September 2018. However, it would be unwise to assume that the exchequer isn’t actively reviewing this as the cost of the state pension ways very heavily on the UK’s budget at £101.198 billion in 2020/21 and has nearly doubled in 15 years, see chart below.

Government expenditure on state pension in nominal terms in the United Kingdom from 2000/01 to 2020/21 (in million GBP)

Potential cost of delay

- call me cynical, though if as expected non-residents become subject to the same costs as most UK residents, or those not meeting the conditions attached to class 2 NICs, the cost of each year’s contribution could increase from £163.80 to £821.60.

- the ability to make voluntary contributions from 2006-2016 expires in April 2025 when it will only be possible to go back to the last 6 UK tax years.

- current processing time for the Government to process additional contributions is up to 12 months.

How to go about it?

The process of securing a forecast and applying for approval to purchase the lowest cost class of NIC available to you requires some form filling, posting back and forth to the UK and possibly providing proof of historical employment records. For those with the time and patience to go through the process there will no doubt be a feeling of great satisfaction upon receiving confirmation the process is complete and an enhanced retirement income has been secured for a little over £3 a week. However for a cost, you can appoint an agent with the authority to deal with the process on your behalf. If you’d like to find out more you can email me at jason@jasonoconnell.com.au.

For the D.I.Y. enthusiast below is a step-by-step guide.

Step 1 – Generate a U.K. state pension forecast:

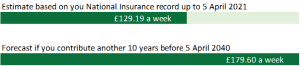

To generate a UK state pension forecast log into or, register for a UK Government Gateway account; Register for or login to UK Government Gateway Account – GOV.UK and follow the instructions. Once logged in go to the state pension section and follow the steps to generate a forecast. If you don’t see the state pension section, click Check my state pension.

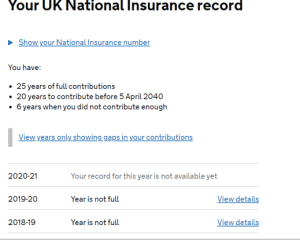

Click on option to “view years only showing gaps in your contributions”

You should be able to see the following screens

Your forecast

*is not guaranteed and is based on the current law

*does not include any increase due to inflation

You need to continue to contribute National Insurance to

£179.60 is the most you can get

You cannot improve your forecast any further, unless you choose to put off claiming

If you currently hold a UK defined benefit pension and would like to know where you stand and what your best options are, please get in touch for some professional advice, tailored to your individual circumstances.

If you are unable to login or register for an account you can complete the form located here; Application for a State Pension forecast – GOV.UK and follow the instructions to submit a request for a forecast by post.

Once you have forecasts, you can identify any gaps and make a request to make additional contributions.

Step 2 – complete the NI38 social security from abroad applying for the class of national insurance contribution appliable to you which as a non-UK resident will be either class 3 or if you fortunate the significantly cheaper class 2. Pop the form into the post (suggest sending express international with Aus post so it gets there quickly and you can track to see when it has arrived)

Step 3 – (optional) call +441912183600 and ask them how long it will take to receive confirmation of how many years you are entitled to retrospectively purchase, and if you’ve applied for class 2, that your application for class 2 has been approved.

Step 4 – Once you receive confirmation of how many years you are entitled to purchase, which class and the cost, make arrangements to transfer the money and wait for confirmation that your top up has been applied and your state pension entitlement increased. You can opt to continue making voluntary contributions each year by direct debit (if you still have a UK bank account)

Further action – now your contact details have been updated, you should receive a letter each year (mid to late April) confirming your entitlement, with the option to top up for that tax year, if you have not yet reached the magic 35 years. Alternatively you can log on to your gateway account after the end of each UK tax year (5 April)

If you found this article useful and know anyone else who might be interested, don’t keep it a secret to yourself. Share by providing the following link jasonoconnell.com.au/ukstatepension

For a chat on anything UK pension, please get in touch with us Jason.oconnell@shartru.com.au

Below is the relevant section of the NI38 social security from abroad

You may be able to pay Class 2 NICs to help you qualify for Contributory Employment and Support Allowance when you get back to the UK, as well as State Pension, Maternity Allowance and Bereavement Support Payment (bereavement benefits before 6 April 2017).

You can pay Class 2 NICs if you’re employed or self-employed abroad and if you satisfy the following conditions.

- You’ve lived in the UK for a continuous 3-year period at any time before the period for which NICs are to be paid*,or

- Before going abroad you paid a set amount in NICs for 3 years or more (this will be checked when you ask to pay Class 2 NICs*),and

- In addition to conditions 1 and 2, you must also, immediately before going abroad, have been ordinarily an employed or self-employed earner in the UK. *If you lived and worked in an EU, EEA country, Switzerland or Turkey, time spent there may help you to meet this condition. You cannot pay Class 2 NICs for any period during which you’re liable to pay Class 1 NICs.

If you want to apply to pay voluntary Class 2 NICs while you’re broad, fill in and return the application form CF83 at the back of this leaflet and on a separate sheet of paper include details of: • your employment(s) • self-employment(s) • periods of registered unemployment during the past 3 years and tell us the date you – gave up work – will give up work before going abroad

Tell us when you intend to start, or have started work abroad and, if possible, supply documentary evidence to support your employment position abroad. If you’re liable for Class 1 NICs do not apply to pay Class 2 NICs until your liability for Class 1 NICs has ended.

———-

Jason O’Connell is an authorised representative (“AR”) of Shartru Wealth Management operating in Australia under AFSL: 422409.

Information on this website is general advice and does not take into account your objectives, financial situation or needs. You should consider whether the advice is suitable for you and your personal circumstances.

Please tell me more.

ken Fergusson

kenjulie1994@gmail.com

.mob 0406342760